what is hospital indemnity high plan

Hospital indemnity insurance policies could also be a wise decision for people with a high-deductible health plan andor a health plan with large out-of-pocket costs. Hospital Indemnity insurance can help lower your costs if you have a hospital stay.

Hospital Indemnity Plan Amerihealth Administrators Newsroom

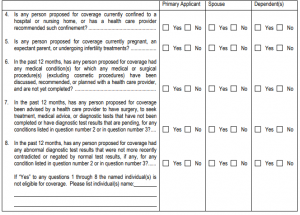

You must first obtain an application to obtain any coverage.

. If you think you might want to. Hospital Indemnity Insurance Family Plans Some hospital indemnity insurance policies may allow you to add family members to your policy. High medical inflation affecting savings.

Additionally major medical treatments and surgical procedures. Hospital indemnity insurance can cover you your spouse and your kids if any of you were to end up in the hospital. Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays.

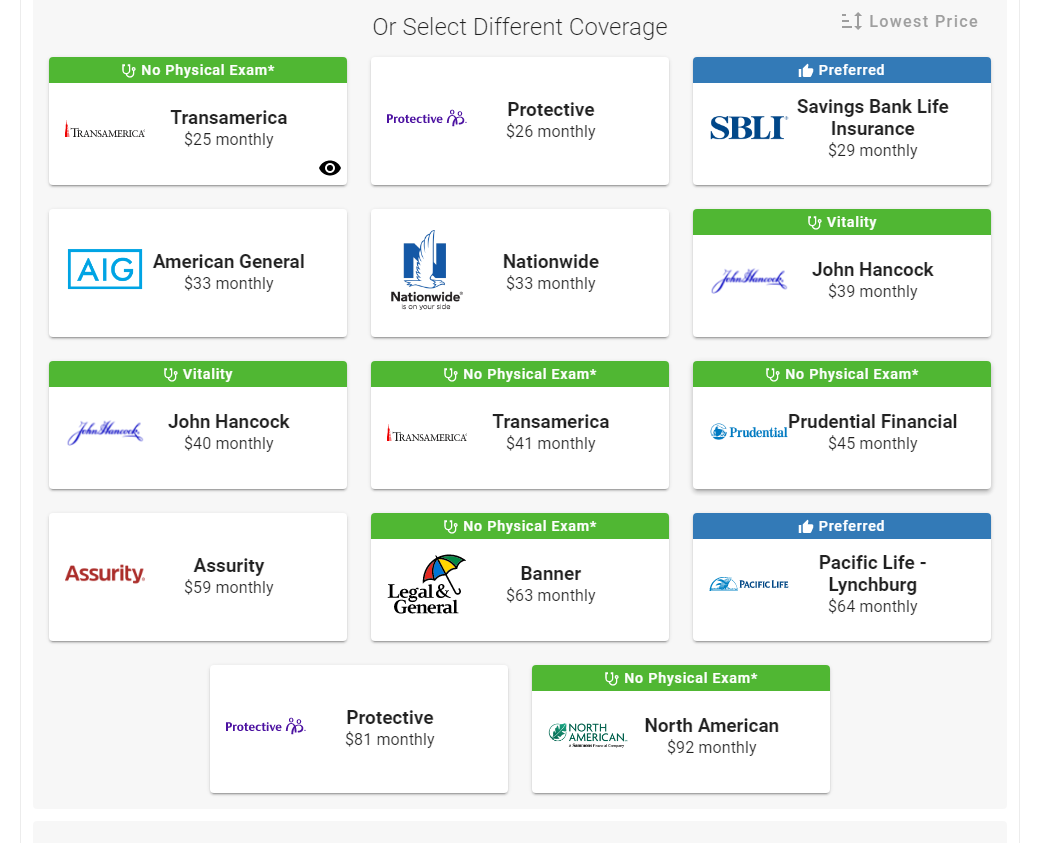

If you are looking for extra financial protection against the unexpectedly high costs of hospitalization then a hospital indemnity plan may be worth considering especially if. Hospital Indemnity plans are typically paid for on a monthly basis. Some plans offered by Health Benefits Connect can be purchased by a simple online application without medical.

Every hospital indemnity insurance plan is different but Aflacs hospital insurance pays the policyholder cash benefits unless otherwise assigned. A Hospital Indemnity plan will give you cash benefits that help pay for the medical expenses associated with a hospital stay. Guardians Hospital Indemnity benefit can help pay for out-of-pocket costs associated with being hospitalized in addition to your medical coverage and can give you more of a financial safety.

While your current health insurance plan may cover. Group Hospital Indemnity insurance can help cover unexpected out-of-pocket expenses such as copays deductibles and out-of-network charges as well as everyday living. These plans can still help financially.

Premium based on the individual rate for a 65-year-old in Alabama with a 6 day 100 hospital confinement benefit. This can be especially helpful if the major medical plans deductible has not been. Hospital Indemnity Insurance can help cover some out-of-pocket medical costs associated with a hospital stay.

Depending on the plan hospital indemnity insurance gives. Global medical inflation is growing at a steady rate of 5 annually. Guaranteed acceptance for you and eligible family members 2.

3 This could be for a broken arm or an. Indemnity health insurance plans have the most advantages if the following apply to you. As part of our base plan our guaranteed issue 4 Hospital Indemnity HI insurance provides a competitive range of first day confinement and daily confinement benefit amounts.

Coverage for hospital admission accident-related inpatient rehabilitation and hospital stays 1. The average price of a hospital stay for seniors is nearly 15000 for a five-day visit. You prefer not to commit to a primary care doctor since the plan does not require you to.

Hospital indemnity insurance is a supplemental insurance plan designed to pay for the costs of a hospital admission that may not be covered by other insurance.

Hospital Confinement Indemnity Insurance Plans Unum

Hospital Indemnity Insurance Senior Benefit Services Inc

Hospital Indemnity Insurance Save Money From Visits 2022

5 Star Hospital Indemnity Policy Indemnity Insurance Plan Compare

Hospital Indemnity Insurance By Bankers Life Casualty Co In Chantilly Va Alignable

Guaranteed Trust Life Gtl Advantage Plus Hospital Indemnity Insurance Policy Surprise Glendale Az

3 Reasons Why Hospital Indemnity Insurance Is Worth It

How Is Aflac Different From Major Medical Aflac

Hospital Indemnity Insurance What You Need To Know

What Is A Hospital Indemnity Plan

Hospital Indemnity Insurance Learn About Hospital Indemnity Coverage Medicare Your Way Llc

What Is Hospital Indemnity Insurance When Is It Worth It Breeze

Hospital Indemnity Texas Medicare Advisors

What Is A Hospital Indemnity Insurance Plan Sunflower Senior Solutions Medicare Supplement Agency

Team Member Care Health Insurance Chick Fil A