how do business loans work in canada

14 hours agoWith a payday loan calculator of course. Online lenders usually take 1 to 2 business days to give.

Lendingclub Online Personal Loans At Great Rates

Business credit cards or personal loans are good for startup capital while day-to-day expense needs are best served by a.

. Your business has access. The amount of a payday loan is typically calculated based on the borrowers income and the length of the loan. The interest rate on a.

You repay the debt in weekly or monthly payments over a period that usually ranges from six to 60. Written by Suzanne Burton. Top Business Loans and Financing for Renovations Providers in Canada Company Amount Interest Rate Reviews Terms 5000 - 300000 Starting at 799 4 - 18 Months Apply Now 1.

A loan is a type of debt that a small business takes on. Your first option is to take out a loan with the Canada Student Loans Program which enables the Canadian government to provide funding for full-time and part-time. BDC Canadas government owned bank for small business and entrepreneurs.

Further a business wants a business loan to work for them. How do I find out how business loans work from the government. Learn how you can get funding for your small.

If you have other debts such as loans or credit cards you may need to provide statements from those accounts. The type of business loan that any enterprise can qualify for is a business line of credit. The main reason is that if the lender can match the loan to the businesss need it reduces the risk on both parties.

When taking out these types of loans consumers should always read the terms carefully before signing any agreement. A personal loan is a lump sum of money borrowed from a financial institution. Asked By Bella Youngs.

The borrower receives a sum of money from the lender which is frequently a corporation financial organization or government. How do I find out how business loans work from the government. How do business loan interest rates work in Canada.

How business loans work. Authorities can issue recommendations and. Business loans provide your company with funding for any business-related expenses like growth filling in cash flow gaps and covering other expenses.

Ad Get Your Small Business Funded Fast. A line of credit works in the same way that a credit card does. This loan is a.

Small businesses looking to purchase or improve their assets for new or expanded operations could benefit from the Canada Small Business Financing Loan CSBFL. Even within the same lender the types of loans available vary.

Small Business Loan Relief Covid 19 Coronavirus Td Canada Trust

Stripe Capital Loans For Small Businesses Startups And More

Small Business Loans The Complete Guide Ondeck Canada

Long Term Working Capital Loans And Financing Priority Lending Commerical Equipment Financing In Pittsburgh Pennsylvania Brampton Ontario

Business Loans And Commercial Mortgages Bmo Canada

How To Get A Business Loan In Canada Bdc Ca

Top Ppp Loan Lenders Updated Approved Banks Providers

Best Business Loans In Canada Comparewise

How Business Loans Work In Canada Nerdwallet

How To Get A Business Loan In Canada Bdc Ca

How To Get A Business Loan In Canada Bdc Ca

How Business Loans Work In Canada Nerdwallet

How To Get A Business Loan In Canada Econotimes

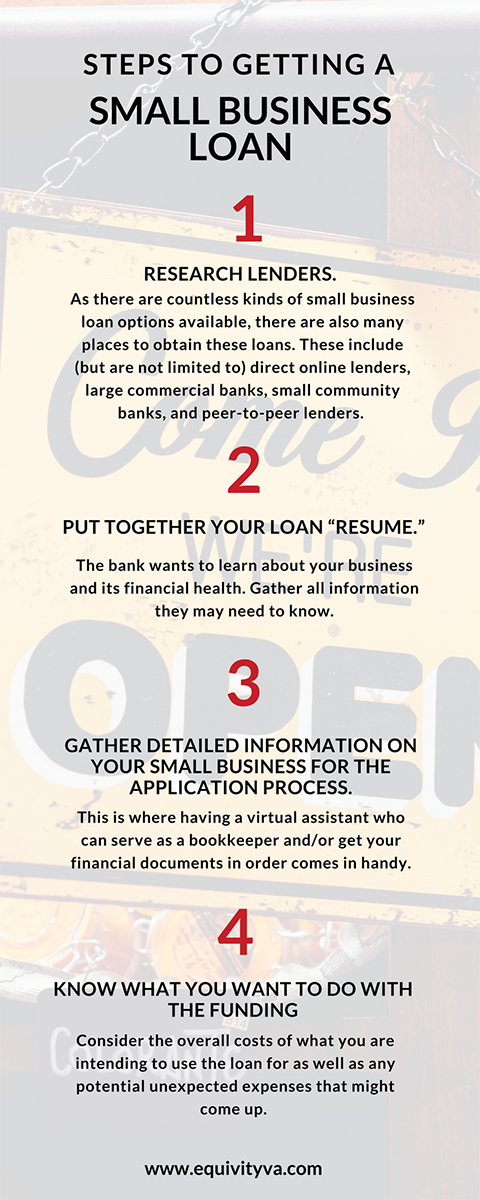

Everything You Need To Know About Small Business Loans Infographic Business 2 Community

Commercial Loans For Small Business Ondeck Canada

Bridge Loans How Do They Work And What Are Their Benefits

Small Business Loans Compare Types Pros Cons How To Apply